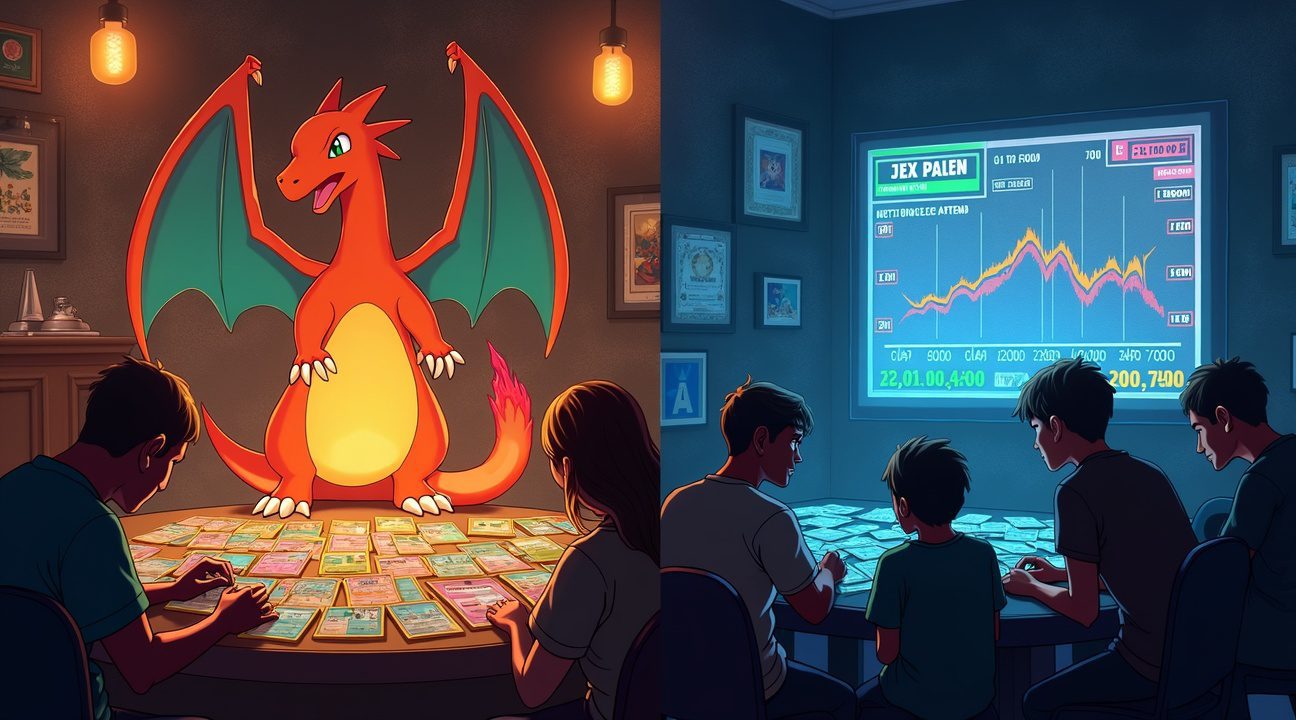

Pokemon trading cards have delivered exceptional investment returns in 2025, generating nearly 46% year-over-year gains that significantly exceed both Bitcoin and conventional stock market performance.

This outstanding success results from a distinctive blend of scarcity factors, nostalgia-driven demand from Gen Z and Millennial collectors, and celebrity endorsements that have elevated these collectibles into credible alternative investment options.

Key Takeaways

- Pokemon cards produced 46% annual returns in 2025, surpassing Nvidia’s sub-40% performance and the S&P 500’s roughly 12% gains.

- Across 20 years, select Pokemon cards have skyrocketed 3,261% in value, far outpacing the S&P 500’s 483% cumulative growth during the same period.

- Celebrity acquisitions like Logan Paul’s $5.3 million Pikachu Illustrator card have boosted market visibility and attracted institutional investors to Pokemon card investing.

- Gen Z and Millennials are driving demand through advanced investment strategies, viewing cards as assets with long-term financial potential rather than mere hobby items.

- Investment risks do exist, including over-reliance on rare vintage cards, potential reprints, dependence on grading services, and speculative market bubbles affecting different cards inconsistently.

For more insight into collectible investments, this analysis by Investopedia offers a broader perspective.

Trading Cards Deliver 46% Annual Returns While Outpacing Top Tech Stocks

Pokemon trading cards have emerged as one of the most impressive performing assets in 2025, delivering returns that make even the hottest tech stocks look modest by comparison. The average Pokemon card achieved nearly 46% year-over-year value growth, according to Card Ladder data, leaving traditional investment darlings in the dust.

This performance puts Pokemon cards ahead of Nvidia, which managed under 40% year-to-date gains by mid-2025, despite being one of the market’s most celebrated performers. The S&P 500’s average return of approximately 12% looks particularly conservative when measured against these collectible investing results.

Two-Decade Performance Shows Explosive Growth

The long-term numbers tell an even more compelling story about Pokemon cards as alternative investments. Over a 20-year span, these trading cards have surged by an astounding 3,261% in value, crushing most traditional equity investments over the same period.

Since 2004, certain Pokemon cards—particularly rare and highly graded specimens—have delivered cumulative returns reaching 3,821%. This performance dwarfs the S&P 500’s accumulated gains of approximately 483% over the identical timeframe, demonstrating just how dramatically collectible investing can outperform conventional asset classes.

Market Dynamics Drive Exceptional Asset Performance

Several factors contribute to these exceptional investment returns in the Pokemon card market. Scarcity plays a crucial role, especially for first-edition cards and those achieving perfect grading scores from authentication services. The combination of nostalgic appeal and genuine rarity creates a powerful foundation for sustained value appreciation.

The grading process itself has become increasingly important for serious collectors and investors. Cards receiving high grades from reputable services command premium prices, often selling for multiples of their ungraded counterparts. This quality differentiation helps explain why some cards achieve those remarkable 3,821% returns while others perform more modestly.

Recent developments in the Pokemon universe continue to fuel interest in trading cards. The new theme park in Tokyo generates fresh excitement around the franchise, while ongoing releases like Pokemon Scarlet and Violet maintain cultural relevance across multiple generations.

Investment-grade Pokemon cards have proven their ability to deliver consistent annual returns that exceed traditional benchmarks. While past performance doesn’t guarantee future results, the underlying fundamentals supporting this market remain strong. Limited supply combined with growing global demand creates conditions that favor continued price appreciation.

The data from Card Ladder reveals that Pokemon cards aren’t just beating stocks—they’re redefining what investors should consider when building diversified portfolios. These collectibles have demonstrated staying power that extends well beyond childhood nostalgia, establishing themselves as legitimate alternative investments worthy of serious consideration.

Smart investors recognize that diversification extends beyond traditional asset classes. Pokemon cards represent a unique opportunity to participate in a market that has consistently delivered outsized returns while operating independently of broader economic cycles that typically influence stocks and bonds.

Holographic Cards and Six-Figure Auction Sales Drive Market Value

Holographic Pokémon cards command extraordinary investment value through their scarcity, specialized production processes, and deep nostalgic connections among collectors. I’ve observed these shimmering cards consistently outpace traditional investments, particularly those from the original 1999–2002 Base Sets that have achieved six-figure auction prices due to their limited supply and profound cultural significance.

Record-Breaking Sales Transform Perception

High-profile collectors have dramatically elevated market visibility and prices across the holographic card segment. Logan Paul’s stunning $5.3 million purchase of the ‘Pikachu Illustrator’ card exemplifies how celebrity involvement amplifies both market attention and valuation expectations. This single transaction shifted perceptions about Pokémon cards from childhood memories to serious investment vehicles, encouraging institutional and high-net-worth individuals to enter the market.

Digital integration through online trading platforms and competitive gaming has created additional demand channels that sustain price momentum. The convergence of nostalgic collectors, competitive players, and speculative investors has established a multi-layered market structure that supports premium valuations for pristine holographic cards.

Grading Standards Define Investment Quality

Third-party grading services, particularly PSA 10 certifications, significantly impact holographic card valuations by providing standardized quality assessments. I’ve seen identical cards vary by thousands of dollars based solely on minor condition differences that affect their grading scores. Even microscopic edge wear or centering issues can devastate the value of high-end holographic cards, making condition preservation critical for serious collectors.

The grading process has created clear market tiers where PSA 10 cards command substantial premiums over lower grades. This standardization has brought institutional confidence to Pokémon card investing, similar to how coin grading transformed numismatics. Professional grading has also enabled more accurate price discovery and reduced transaction friction in high-value sales.

Base Set holographic cards continue driving the strongest returns due to their foundational role in Pokémon’s cultural impact. Cards featuring iconic characters like Charizard, Blastoise, and Venusaur from these original sets represent the purest form of Pokémon nostalgia, connecting directly to childhood experiences of millions of now-wealthy millennials. The combination of:

- limited original print runs

- high childhood usage rates that damaged most copies

- sustained cultural relevance

…creates perfect conditions for appreciation that often exceeds traditional financial instruments.

Market dynamics suggest holographic Pokémon cards have established themselves as legitimate alternative investments, with auction results consistently surprising even seasoned collectors and demonstrating resilience that rivals or exceeds conventional assets during volatile economic periods.

Watch Logan Paul’s purchase of the ‘Pikachu Illustrator’ card here:

https://www.youtube.com/watch?v=2ocHgZmmtJY

Gen Z and Millennials Fuel Record-Breaking Market Activity

Gen Z and Millennials have become the powerhouse behind Pokemon’s unprecedented market surge, with young men leading the charge in treating these colorful cards as serious financial instruments. These generations don’t just see Pokemon cards as childhood memorabilia—they’ve transformed them into legitimate investment vehicles that compete with traditional assets.

The numbers tell a compelling story about this demographic shift. eBay recorded nearly 14,000 searches per hour for ‘Pokemon’ in 2024, demonstrating the intense demand driving this market explosion. Resale platforms have experienced nine consecutive quarters of growth, proving that this isn’t a temporary fad but a sustained economic phenomenon.

Major retailers have struggled to keep pace with the overwhelming demand. Walmart and Target have faced persistent card shortages, forcing them to impose purchase limits and sometimes even temporary moratoriums on Pokemon card sales. These restrictions highlight how mainstream retail channels can’t adequately supply the voracious appetite of modern collectors.

Investment Psychology Drives Purchasing Decisions

Collectors increasingly approach Pokemon cards with sophisticated investment strategies, using what’s commonly called ‘boy math’ to justify their purchases as calculated financial decisions rather than impulse buys. This mindset shift represents a fundamental change in how collectibles are perceived and valued.

The collectibles market has evolved beyond simple nostalgia-driven purchases. Young adults now analyze Pokemon cards with the same scrutiny they’d apply to stock picks or cryptocurrency investments. They:

- Research market trends

- Track card values

- Make strategic acquisitions based on potential returns

This generation grew up during economic uncertainty, making them naturally drawn to alternative investment opportunities. Pokemon cards offer something traditional markets can’t—tangible assets with emotional value that have consistently outperformed conventional investments. The combination of nostalgia and financial potential creates a perfect storm for sustained market growth.

Pokemon’s recent market performance has caught the attention of financial analysts who previously dismissed collectibles as niche markets. The sustained growth across multiple quarters suggests that Pokemon’s staying power extends far beyond gaming into legitimate investment territory.

The resale market’s expansion reflects broader changes in how younger generations approach wealth building. They’re diversifying portfolios with assets their parents never considered, creating new economic ecosystems around childhood favorites. This trend shows no signs of slowing as more young adults enter their peak earning years with disposable income to invest in alternative assets.

Market Concentration Creates Investment Risks and Speculation Concerns

The Pokemon card market’s impressive performance comes with significant caveats that potential investors must understand. While headlines celebrate extraordinary returns, these gains concentrate almost exclusively in rare, pristine-condition cards from the earliest sets, particularly Base Set cards from 1998-2000.

Modern card packs and ungraded cards rarely generate meaningful appreciation. I’ve observed that mass-produced contemporary releases often struggle to maintain their retail value, let alone provide investment returns. The market’s strength relies heavily on scarcity, which newer printings simply don’t possess.

Grading and Population Reports Drive Price Volatility

Third-party authentication services like PSA and BGS wield enormous influence over card values through their grading standards and population reports. These reports track how many copies of each card exist in various condition grades, directly affecting market pricing.

Cards with lower population counts in mint condition command premium prices, but this system creates artificial scarcity that can shift rapidly. When grading companies adjust their standards or when additional high-grade copies surface, prices can plummet without warning. I’ve seen cards lose 30-50% of their value when population counts increase unexpectedly.

The authentication process itself introduces speculation risks. Resubmissions of the same card seeking higher grades can alter population dynamics, while Pokemon’s continued popularity drives more collectors to submit cards for grading, potentially flooding certain categories.

Reprint Risks and Market Manipulation Concerns

Pokemon’s parent company retains the right to reprint any card, which poses an existential threat to investment values. Although reprints typically feature different artwork or set symbols, the mere possibility can suppress prices for cards not explicitly guaranteed as limited editions.

Speculation bubbles form when investors chase headline-grabbing returns without understanding market fundamentals. The Pokemon card investment space attracts participants who mistake isolated success stories for systematic opportunities. Media coverage often highlights six-figure card sales while ignoring thousands of cards that fail to appreciate or actively lose value.

Market manipulation presents another concern, particularly with lower-population cards where small groups can influence pricing through coordinated buying. Unlike regulated financial markets, collectible card trading operates with minimal oversight, making price manipulation both easier and harder to detect.

Celebrity endorsements and social media hype can create temporary price spikes that don’t reflect genuine demand. I’ve watched cards double in value based on influencer mentions, only to crash weeks later when attention shifts elsewhere. These patterns mirror classic speculative bubbles seen in other alternative investments.

The concentration of value in specific card categories means portfolio diversification within Pokemon cards offers limited protection. Most investment-grade cards come from the same era and face similar risks from reprints, condition concerns, and market sentiment shifts.

Professional grading services represent both an opportunity and a risk factor. While authentication adds credibility and liquidity to the market, it also creates dependency on these companies’ continued operation and consistent standards. Changes in grading criteria or company policies can dramatically affect card values across the entire market.

Storage and preservation costs add ongoing expenses that eat into returns. Mint-condition cards require climate-controlled environments and protective storage, while insurance for high-value collections can be expensive and difficult to obtain.

I recommend extreme caution for anyone considering Pokemon cards as a serious investment vehicle. The market’s performance stems from unique cultural factors and nostalgia that may not persist indefinitely. Unlike stocks or cryptocurrencies, cards don’t generate income or serve functional purposes beyond collecting and gaming.

The entertainment franchise’s growth supports collector interest, but investment returns depend heavily on continued cultural relevance and new collector generation participation. Economic downturns typically hit collectibles markets harder than traditional investments, as discretionary spending contracts first.

Rather than viewing Pokemon cards as portfolio components, collectors should approach them as hobby purchases that might appreciate over time. This mindset helps avoid the speculation traps that catch investors expecting guaranteed returns from a fundamentally unpredictable collectibles market.

Pokemon Cryptocurrencies Lag Far Behind Physical Cards

While physical Pokemon cards have delivered impressive returns for collectors and investors, Pokemon-branded cryptocurrencies tell a dramatically different story. These digital tokens have struggled to capture the same market enthusiasm that drives Pokemon’s sustained relevance in gaming and entertainment.

Disappointing Market Performance and Low Valuations

PokeCoin currently maintains a modest market capitalization of approximately $70,000 as of September 2025, reflecting the limited investor interest in Pokemon crypto ventures. This relatively small market cap demonstrates how these digital assets haven’t achieved the widespread adoption that their physical counterparts enjoy. The POKEMON coin and similar branded cryptocurrencies face similar challenges, with most trading at minimal volumes and showing little correlation to the broader Pokemon brand’s success.

Negative ROI Forecasts Paint Grim Picture

Financial analysts project concerning outlooks for Pokemon cryptocurrencies through 2028. Short-term and long-term ROI forecasts consistently show negative or flat performance expectations, with potential returns ranging from -22% to -43% over the next few years. These projections stand in stark contrast to the significant appreciation many physical Pokemon cards have experienced.

The fundamental issue lies in what these cryptocurrencies actually represent. Unlike physical cards that carry deep nostalgia and tangible collector value built over decades, Pokemon crypto tokens operate as largely speculative investments without meaningful connection to the beloved franchise. They don’t capture the emotional attachment that drives collectors to seek out rare Charizard cards or complete vintage sets.

Most analysts don’t expect significant appreciation in Pokemon cryptocurrencies because they lack the scarcity, authenticity, and cultural significance that physical cards possess.

While Detective Pikachu 2 and other franchise developments continue generating excitement for traditional Pokemon products, these announcements rarely translate into meaningful gains for related crypto tokens. The disconnect between Pokemon’s brand strength and its cryptocurrency performance highlights how digital tokens can’t simply leverage popular intellectual property to guarantee investment success.

Sources:

Fortune, “Gen Z men are still obsessed with Pokemon cards—using ‘boy math’ to argue that they’ll beat Nvidia stock and the S&P 500”

Economic Times, “Pikachu’s wild run: Pokemon Cards give 3,821% return to blow past S&P 500’s 483%”

AInvest, “The Investment Potential of Holographic Pokemon Cards in 2025”

SwapSpace, “Pokemon Price Prediction: Can POKEMON Reach $1?”

Card Ladder (as reported in media)

Phantom, “New Pokemon Crypto Coin (PokeCoin) Price Chart”