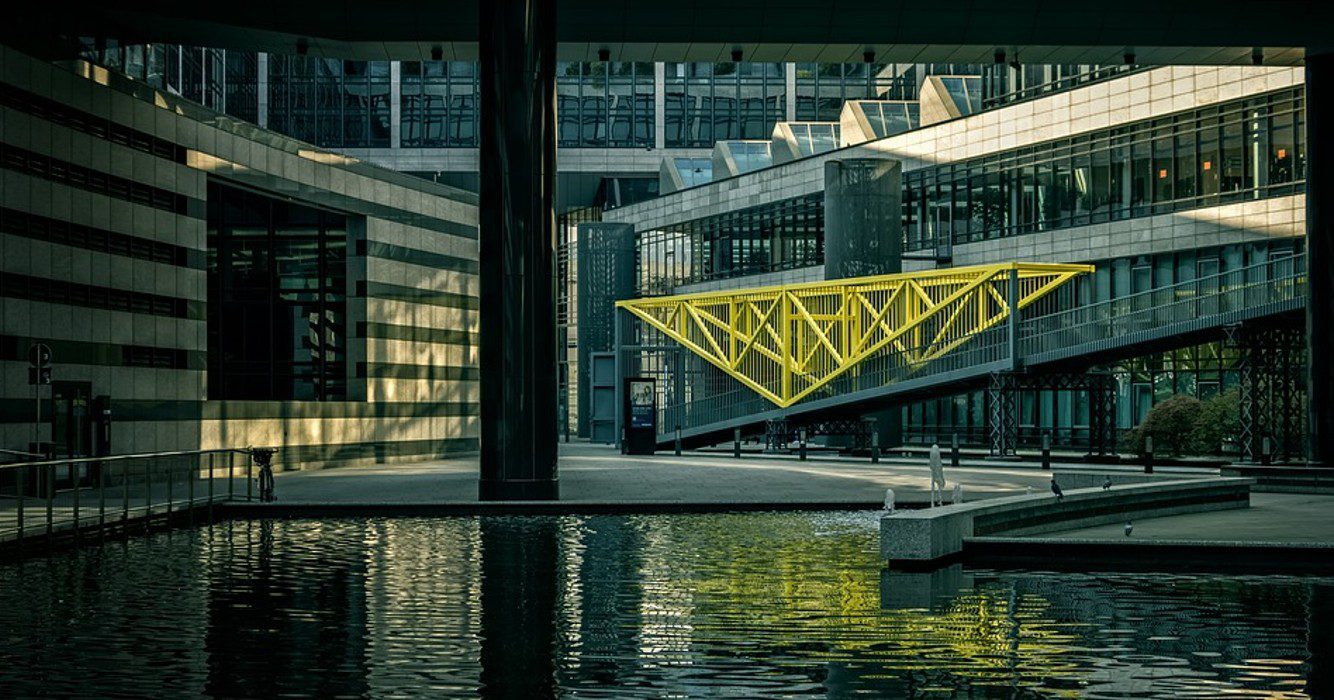

First Republic was the third significant financial institution to fall in the US in the previous two months. The troubled First Republic Bank in California was then taken over by US financial regulators, who then sold it to JPMorgan Chase in an effort to end the two-month banking crisis that has shaken the financial system.

Massive Numbers

In the early-Monday deal, JP Morgan will acquire from the failed lender $92 billion in deposits, $173 billion in loans, and $30 billion in securities. The amount that the massive banking organization would pay was not disclosed. After revealing last week that it had seen more than $100 billion in withdrawals in the first quarter and was considering its options, First Republic came under strong pressure. Additionally, it put additional strain on the banking industry, which was already under duress following the March closures of Silicon Valley Bank and Signature Bank and the state-engineered acquisition of Credit Suisse by competitor UBS.

A Crucial Decision

In premarket trading, First Republic Bank shares fell 43.3 percent. This year, the stock has lost 97% of its value. Shares of JPMorgan increased by 2.7%. According to people familiar with the situation over the weekend, JPMorgan was one of several potential purchasers of First Republic, along with PNC Financial Services Group and Citizens Financial Group, who made final bids on Sunday in an auction being conducted by US regulators. First Republic has been taken over, according to the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation will serve as its receiver.

The Deposit Insurance Fund will incur an estimated $13 billion in costs, according to a statement from the FDIC; the actual amount will be known once the receivership is over. The FDIC also announced early on Monday that JPMorgan Chase Bank will reopen its 84 locations in eight states as First Republic Bank branches, giving depositors complete access to all of their funds.