Owner of a snack firm made a costly error that would cost him $220 million, but his enormous risk paid off as he received a $5 billion return.

I only make life mistakes…

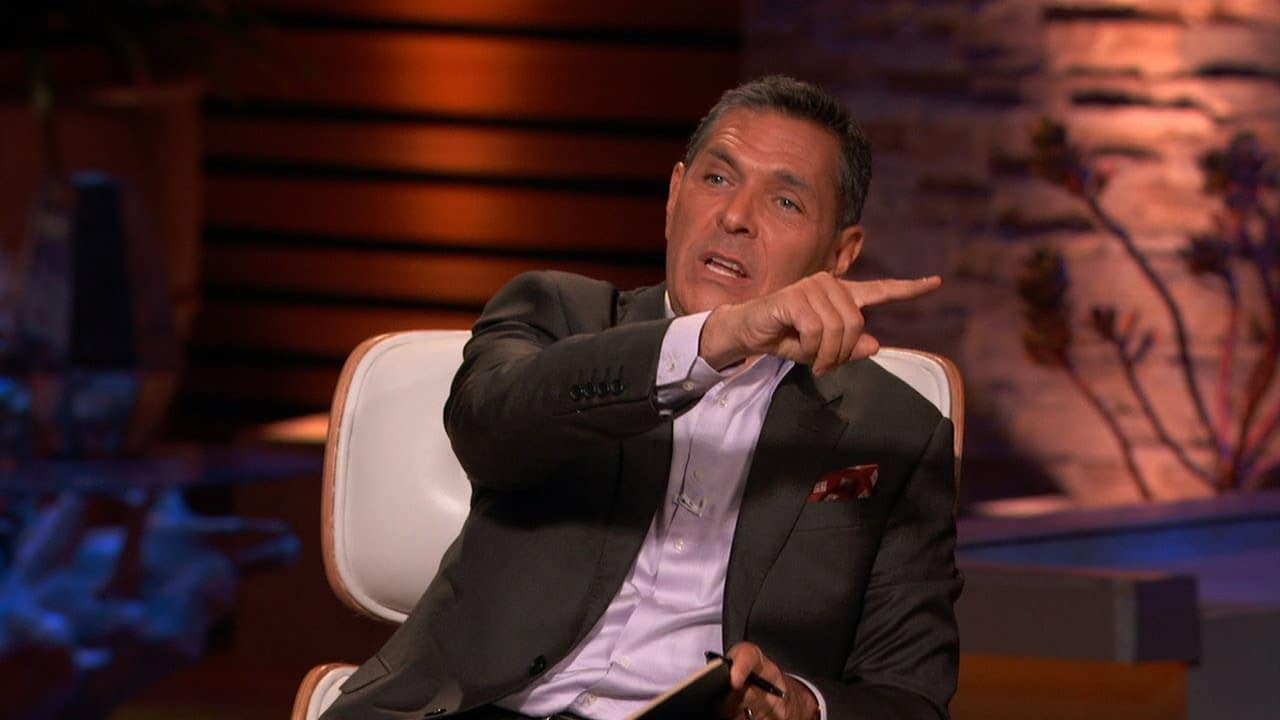

This is the amazing tale of Daniel Lubetzky, the person responsible for Kind Snacks.

The brand is already well-known; visit any supermarket and you’ll find Kind’s nutritious snack bars, which are renowned for being tasty and including recognizable ingredients like almonds and whole grains.

But it wasn’t nearly as well known back then as it is now.

Its origins were a $16 million fund from the private equity firm VMG Partners, as described in CNBC Make It’s The Moment series of the time.

An important provision of the arrangement required Lubetzky to sell his business within five years in exchange for the investment.

Even though it looked like a good plan at the time, after four years he had seen Kind develop and was convinced he was still the right candidate.

He told the magazine, “Four years into the deal, I was seeing that Kind might become so much bigger.

“My investors were keen to see me sell the business and were pressuring me to do so.

“My goal was to see the business grow for many years to come. Their goal was to exit the business and recover their investment.

Lubetzky had a difficult choice to make: abandon the business and risk missing out on one of his life’s most important tasks, or figure out a method to repurchase the business from VMG.

Even though the latter alternative appears like the best one, he would need to find $220 million for the deal and take a chance on losing everything in order to make it happen.

He took the decision to take a leap of faith, but it wasn’t taken lightly.

“I got a really strong feeling that this was not the end — nor the beginning of the end — but the beginning of the beginning,” said Lubetzky. “And I wanted to keep going.” He continued.

“But that was a nerve-wracking time. What if something goes wrong? Suddenly, you’ll be in so much debt that you might even lose your business.

“I couldn’t sleep at night. We most likely had a loan for about $200 million.

Even though he had done his homework and was confident in Kind’s future, anything can happen.

However, the procedure wasn’t easy and the negotiations continued until 2014.

Sales more than doubled that year alone, as reported by CNBC, and when Lubetzky attempted to sell off Kind to Mars six years later, it was reputedly worth a staggering $5 billion.

According to Lubetzky, “I am still a significant stakeholder in Kind today, and I still mentor them.”

“Kind is still expanding by double digits, and we’ve agreed with our colleagues at Mars that Kind will be a separate standalone platform.

“It’s not only that following this route has brought me more financial success. Kind might not have currently reached the tens of millions of customers daily if this had not happened.