League of Legends has experienced a significant player decline, dropping from approximately 152 million monthly active users in 2022 to between 131-132 million in 2025, representing a decrease of at least 30 percent over three years.

Despite this substantial loss, the game continues to rank among the most-played titles globally. However, regional data reveals particularly sharp declines in North America and Europe, where competitive player participation has contracted by over 15 percent in just one year.

Key Takeaways

- League of Legends has lost 21–23 million players between 2022 and 2025, with monthly active users falling from 152 million to approximately 131–132 million.

- Europe’s ranked accounts fell by 15.5%, from 3.08 million in May 2024 to 2.6 million in May 2025. North America saw similar trends.

- Controversial monetization changes — including the removal of free Hextech chests and the introduction of gacha-style systems — have led to widespread dissatisfaction and player churn.

- Increased competition from newer titles such as Riot’s own Valorant, alongside the complexity of the expanding champion roster and enduring smurfing issues, has also contributed to the player decline.

- League of Legends still maintains a strong player base, with over one million concurrent users during peak hours, keeping pace with other major titles like Fortnite and Counter-Strike.

League of Legends Monthly Player Count Drops to 131 Million in 2025

League of Legends has experienced a steady decrease in its global monthly active user base over the past three years. I’ve analyzed the data showing how this iconic multiplayer online battle arena game has lost a significant portion of its audience since reaching its recent peak popularity.

Documented Player Count Decline

The numbers paint a clear picture of declining engagement. In 2022, League of Legends maintained approximately 152 million monthly active users at its highest point. This figure represented the game’s strongest performance in recent years before the downward trend began taking hold.

By 2023, the live player count had dropped slightly to 151 million MAU, marking the beginning of what would become a consistent pattern. The decline accelerated through 2024 and into 2025, with current estimates placing the monthly active users between 131 to 132 million.

This trajectory represents a substantial loss of 21–23 million players over the three-year period. The decline translates to approximately 14–15% of the total player base abandoning the game since 2022. Such a decrease signals a notable shift in the competitive gaming landscape, particularly striking given gaming’s overall growth in recent years.

Sustained Downward Momentum

The consistency of this decline distinguishes it from typical seasonal fluctuations that multiplayer games experience. Year-over-year comparisons reveal an uninterrupted downward trend that has persisted through 2025 without signs of recovery.

Gaming industry observers have noted similar patterns affecting other established titles. Players abandoning games after initial popularity peaks has become increasingly common as new entertainment options compete for attention.

The MOBA genre itself faces heightened competition from emerging game types and platforms. Streaming services and content creators have also shifted focus, with some prominent figures experiencing their own challenges in maintaining audience engagement, as seen when major streamers face platform restrictions.

Despite these concerning trends, League of Legends still maintains a massive global audience. The current 131–132 million monthly active users represents a player base that many games would consider extraordinary. However, for a title that once seemed destined for perpetual growth, these numbers indicate a fundamental shift in player preferences and engagement patterns that developers must address strategically.

North America and Europe See Massive Player Losses

The most dramatic evidence of League of Legends’ declining playerbase emerges from North America and Europe, where traditional strongholds of the game face unprecedented drops in active users. These regions, historically considered cornerstones of League’s Western audience, now represent the sharpest contractions in the game’s global footprint.

Regional Breakdown of Player Losses

North America stands out as particularly affected, with ranked player segments experiencing the steepest declines by 2025. The region’s competitive scene, once a thriving ecosystem that attracted millions of aspiring players, has contracted significantly. This reduction impacts not just casual gameplay but the entire infrastructure supporting professional esports and content creation.

Europe follows closely with concrete data revealing the scope of regional decline. Ranked accounts dropped from approximately 3.08 million in May 2024 to about 2.6 million in May 2025, representing a 15.5% decrease within just one year. This percentage decrease translates to nearly half a million fewer active competitive players across European servers.

Several factors contribute to these regional contractions:

- Increased competition from newer gaming titles drawing players away

- Aging core demographic moving away from competitive gaming

- Market saturation reaching natural limits after years of growth

- Economic pressures affecting gaming spending and time investment

- Platform diversification as players explore alternatives to traditional PC gaming

The implications extend beyond raw numbers. Reduced player counts in North America and Europe affect queue times, matchmaking quality, and overall game experience. Longer waits for ranked matches create frustration cycles where departing players accelerate further exodus. Professional scenes in both regions also feel pressure as viewership correlates with active playerbase size.

Gaming preferences shift constantly, and League faces intensified competition from battle royales, mobile games, and emerging genres. Streaming platforms amplify this effect by showcasing trending alternatives that capture audience attention formerly dedicated to League content.

While other global regions don’t experience identical rates of decline, the Western market losses signal broader industry trends. Asia-Pacific regions maintain relatively stable numbers, but even these territories show subtle downward trajectories rather than the explosive growth characterizing League’s earlier years.

The ranked accounts metric provides particularly valuable insight because it represents engaged, committed players rather than casual participants. These users typically invest significant time and often money into the game through cosmetic purchases and battle pass systems. Their departure creates compound effects on revenue streams and community vitality.

Recovery strategies must address regional preferences and competitive landscapes unique to North America and Europe. Player retention challenges aren’t unique to League, as many established games face similar demographic shifts and market evolution pressures.

Queue health deterioration becomes especially problematic at higher skill tiers where fewer players exist naturally. Master and Challenger ranks in both regions report extended wait times that push competitive players toward alternatives offering faster, more consistent matchmaking experiences.

The social aspect of League also suffers as friend groups fragment when core members leave for different games. Network effects that once drove growth now work in reverse, accelerating departures as social connections weaken within the game environment.

Content creators contribute to these regional decline patterns by diversifying their streaming focus beyond League-exclusive content. Popular streamers branching into variety content signals shifting audience demands and creates feedback loops affecting community engagement levels across North America and Europe.

Monetization Changes and Competition Drive Players Away

I’ve observed significant shifts in how League of Legends generates revenue, and these changes haven’t been well-received by the community. The removal of free Hextech chests represents one of the most controversial decisions Riot Games has made, eliminating a system that previously rewarded players with cosmetic items at no cost. This change forced players to spend money for content they once earned through gameplay, creating immediate friction within the established player base.

The introduction of gacha-style skin systems has further alienated long-time supporters. Players now face randomized reward structures that require multiple purchases to obtain desired items, replacing the straightforward purchase model that previously defined League’s monetization approach. Combined with noticeably lower-quality skins and reduced rewards from battle passes, these modifications have created a perfect storm of community dissatisfaction.

Esports Plateau and Rising Competition

League’s esports scene, once a powerful growth driver, has reached a plateau that coincides with declining player numbers. Viewer engagement and participation peaked during 2021–2022, but maintaining those high levels has proven challenging. The competitive scene that once drew millions to the game now struggles to attract new audiences or retain existing viewers.

Competition from newer titles has intensified pressure on League’s player retention rates. Video games have become increasingly popular entertainment options, and Valorant, ironically another Riot Games release, has successfully captured significant portions of League’s target demographic. This internal competition has created an unusual situation where Riot’s own products compete against each other for player attention and time investment.

Complexity and Community Issues

The growing complexity of League’s champion roster and in-game systems has created barriers for both new and returning players. Each champion release adds layers of interaction and strategic depth that can overwhelm newcomers, while veteran players often express frustration with constant meta shifts and mechanical updates to existing champions.

Smurfing has emerged as a persistent problem that affects player retention across all skill levels. Experienced players creating lower-ranked accounts to gain advantages disrupts the matchmaking experience for genuine beginners and intermediate players. This practice contributes to new player drop-off rates and creates toxic environments that discourage continued participation.

Several factors compound these retention challenges:

- Inconsistent punishment systems for disruptive behavior

- Extended queue times in certain regions and ranks

- Regular balance changes that invalidate player investment in specific champions

- Limited meaningful progression systems outside of ranked play

The combination of aggressive monetization strategies, increased competition, and persistent community issues has created conditions similar to what I’ve seen in other declining multiplayer games. Player base decline isn’t unique to League, but the specific factors affecting this title reveal deeper structural problems within the game’s ecosystem. These monetization changes, particularly the shift away from player-friendly reward systems, have damaged the relationship between Riot Games and its community in ways that extend beyond simple gameplay preferences.

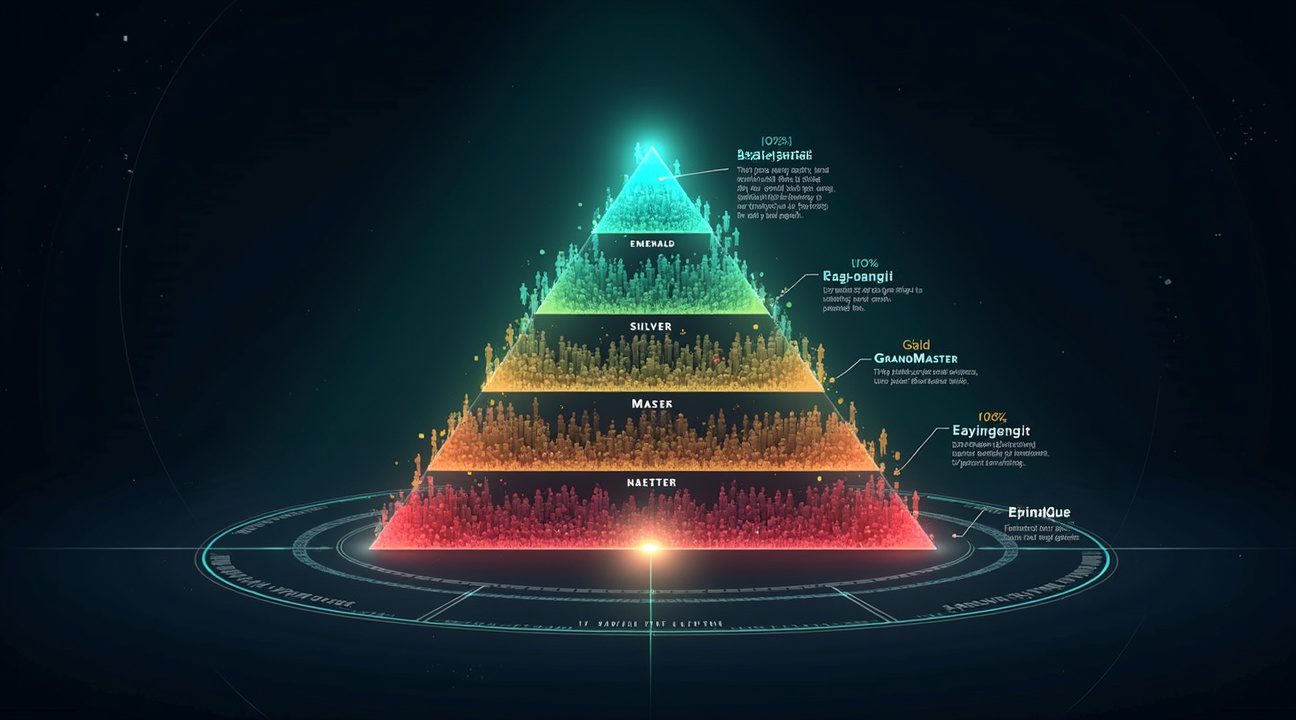

Current Player Rankings Show Concentration in Middle Tiers

The ranked distribution in League of Legends reveals a fascinating pattern where the vast majority of active players cluster around the middle tiers of the competitive ladder. Over 80 million players globally find themselves positioned within the Silver, Gold, and Platinum ranks, creating a dense concentration that reflects both the game’s ranking algorithm and natural skill distribution patterns.

Middle Tier Dominance Shapes Player Experience

Silver, Gold, and Platinum tiers collectively house the core of League’s competitive community, representing roughly 70% of all ranked players. This concentration isn’t accidental—Riot Games designs the ranked system to funnel most players into these middle brackets, creating what they consider the optimal competitive experience for the majority. Gold rank specifically serves as many players’ aspirational goal, offering meaningful rewards while remaining achievable for dedicated players.

The introduction of the Emerald tier between Platinum and Diamond has significantly altered these dynamics. This addition was specifically designed to address player frustration with perceived stagnation and provide more granular progression markers. Players who previously felt stuck at the top of Platinum now have an additional tier to climb through, which has helped maintain engagement levels during a period when gaming preferences have been shifting across the industry.

Elite Ranks Maintain Extreme Exclusivity

At the opposite end of the spectrum, fewer than 15,000 accounts worldwide have achieved Challenger or Grandmaster status. This represents less than 0.02% of the total ranked playerbase, emphasizing just how exclusive these tiers remain. Challenger rank, capped at exactly 200 players per region, functions as League’s ultimate competitive achievement.

This extreme scarcity at the top creates a pyramid structure that influences player motivation throughout the entire ranked system. Many players use these elite ranks as aspirational benchmarks, even if they’ll never realistically reach them. The psychological impact of knowing that millions of other players occupy similar skill levels can be both comforting and motivating, depending on individual player perspectives.

Recent adjustments to the ranked system reflect Riot’s ongoing efforts to balance progression satisfaction with competitive integrity. The player rank distribution changes have helped address some concerns about rank inflation while maintaining clear advancement paths. However, these modifications come at a time when League faces broader challenges, including competition from other games and changing player preferences that have contributed to overall playerbase fluctuations across the gaming industry.

League of Legends Still Dominates Despite Declining Numbers

Despite experiencing a notable drop in its playerbase since 2022, League of Legends maintains its position as one of the most-played games worldwide. The MOBA continues to command impressive monthly active user numbers, placing it alongside gaming giants like Fortnite, Counter-Strike, and Minecraft in the competitive landscape.

Sustained Competitive Presence

Current data reveals that League of Legends consistently maintains over one million concurrent players during peak hours. This live player count demonstrates the game’s enduring appeal within the competitive gaming community. Recent industry trends show that video games remain dominant in entertainment consumption, and League continues to benefit from this broader shift.

The esports ecosystem surrounding League of Legends remains particularly strong. Professional tournaments still draw massive audiences, with the game’s competitive scene continuing to attract both players and viewers. Major esports organizations maintain their League rosters, indicating continued confidence in the title’s long-term viability.

Market Position Among Gaming Titans

League’s ability to compete with other major titles speaks to its fundamental strengths. While some games have experienced more dramatic fluctuations — such as declining player numbers in single-player titles — League’s multiplayer nature provides more consistent engagement patterns. The game’s free-to-play model and regular content updates help maintain its relevance in an increasingly crowded market.

The competitive gaming landscape continues to evolve, with various titles experiencing both growth and decline cycles. League’s sustained presence among the top-tier games demonstrates its resilience compared to other entertainment properties that have faced challenges. Even as streaming platforms navigate changes — like when major streamers face platform restrictions — League content creators continue to find audiences.

Industry analysts note that while the 30 percent decline represents a significant shift, League’s baseline remains exceptionally high compared to most titles. The game’s infrastructure, including its ranking system, seasonal updates, and championship series, continues to drive engagement. This sustained activity level positions League of Legends as a cornerstone of modern competitive gaming, even as it adapts to changing player preferences and market conditions.

Sources:

TurboSmurfs — “League of Legends: Player Count and Statistics 2025”

BO3.gg — “League of Legends: Player Count and Statistics 2025”

ActivePlayer.io — “League of Legends Live Player Count and Statistics”

YouTube — “Is Riot Games Actually Dying in 2025? (Explained)”

YouTube — “Huge Player Base Decline Isn’t Limited To NA”

YouTube — “The Decline of League of Legends’ Playerbase (in 2025)”