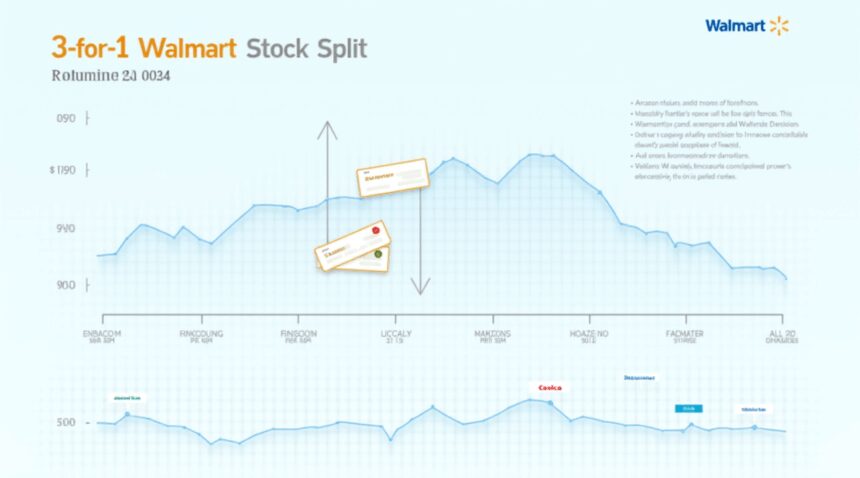

Walmart’s 3-for-1 stock split in February 2024 marked its return to stock splitting after a 25-year pause, lowering share prices to approximately $95.05 while maintaining a market capitalization of $758.54 billion.

Key Takeaways

- Walmart executed its 12th stock split on February 26, 2024, transforming one original IPO share into 1,536 shares through cumulative splits going back to 1970.

- The stock split significantly reduced share prices from higher levels to approximately $95.05, making shares more accessible to retail investors while preserving the overall investment value.

- Strong business performance drove the split decision, including 27% year-over-year e-commerce growth, ongoing revenue increases, and a 10.5% dividend hike.

- The 25-year gap since the last split in 1999 reflects evolving market conditions, growing institutional ownership now at 72%, and the impact of fractional share trading on accessibility.

- Walmart’s stock split activity outpaces competitors such as Target (5 splits), Costco (2 splits), and Amazon, which conducted a single 20-for-1 split in 2022.

For those interested in further details about Walmart’s corporate and investment strategies, the official Walmart corporate website provides insightful resources and updates.

Walmart’s Historic 3-for-1 Stock Split in February 2024 Transforms Shareholder Value

Walmart executed a significant 3-for-1 stock split on February 26, 2024, marking a strategic move to broaden investor accessibility. This split reduced the trading price per share while proportionally increasing the number of outstanding shares in circulation.

Following the Walmart stock split, shares traded at approximately $95.05 per share, establishing a total market capitalization of $758.54 billion. This price point represents a substantial decrease from the pre-split trading levels, making individual shares more affordable for retail investors who previously found the higher per-share cost prohibitive.

The mechanics of this split mean existing shareholders received two additional shares for every share they owned before the split date. A shareholder who previously held 100 shares suddenly owned 300 shares, though the total value of their investment remained unchanged. This mathematical adjustment doesn’t alter the fundamental value of the company but redistributes that value across a larger number of shares.

Enhanced Market Accessibility and Liquidity Benefits

Stock splits serve multiple strategic purposes that extend beyond simple arithmetic. The primary benefit lies in democratizing access to blue-chip stocks like Walmart. The split enables smaller investors to purchase full shares rather than relying on fractional share programs offered by some brokerages.

Increased liquidity often accompanies stock splits as more investors can participate in trading. The broader investor base typically leads to:

- Higher trading volumes as more market participants can afford full share purchases

- Reduced bid-ask spreads due to increased market activity

- Greater price discovery efficiency through expanded participation

- Enhanced options trading opportunities with more affordable strike prices

The psychological impact proves equally important. Many investors prefer owning round lots of 100 shares, which becomes more achievable at lower per-share prices. This preference stems from traditional trading practices and the desire to avoid fractional share complexities.

For existing shareholders, the 3-for-1 stock split creates no immediate tax consequences. The cost basis per share adjusts proportionally, maintaining the same total investment value while providing three times the number of shares. This adjustment preserves the original purchase date for tax purposes, ensuring long-term capital gains treatment remains intact for qualifying positions.

Walmart’s decision reflects confidence in its long-term prospects and commitment to shareholder value creation. Companies typically announce splits when stock prices reach levels that management believes may deter smaller investors. The timing suggests Walmart’s leadership recognizes the importance of maintaining broad-based ownership across diverse investor segments.

The split also positions Walmart favorably within global equity markets where accessibility increasingly drives investment decisions. Younger investors, particularly those using commission-free trading platforms, often gravitate toward stocks they can purchase in meaningful quantities without requiring substantial capital commitments.

Market reception of the split demonstrated positive investor sentiment, with trading activity increasing in the weeks following the announcement. The enhanced affordability attracted new shareholders while existing investors maintained their proportional ownership stakes in the retail giant.

This strategic move aligns with Walmart’s broader corporate strategy of maintaining market leadership while adapting to evolving investor preferences. The company’s $758.54 billion market capitalization represents one of the largest retail operations globally, and the split ensures this value remains accessible to a diverse investor community.

The split’s timing coincided with Walmart’s strong fundamentals, including consistent revenue growth and expanding e-commerce operations. This combination of financial strength and enhanced accessibility creates an attractive proposition for both institutional and retail investors seeking exposure to the consumer staples sector through one of America’s most established retail brands.

How One Original IPO Share Became 1,536 Shares Through 12 Strategic Splits

I’ve witnessed many stock splits throughout my years analyzing the markets, but Walmart’s approach to splitting shares stands out as particularly strategic and consistent. Since going public in 1970, Walmart has executed an impressive 12 stock splits, creating one of the most remarkable shareholder value stories in corporate history.

Walmart’s Stock Split Strategy Through the Decades

The retail giant’s commitment to making its stock more accessible through regular splits has created extraordinary results for early investors. Most of these splits followed a 2-for-1 pattern, which became Walmart’s signature approach to managing share price growth. I find it fascinating how this consistent strategy helped maintain the stock’s affordability for retail investors while the company grew from a small Arkansas retailer into a global powerhouse.

The recent three-for-one split on February 26, 2024, marked a departure from the traditional 2-for-1 format, but it maintained the company’s philosophy of keeping shares accessible to individual investors. This split frequency—averaging roughly one split every 4.5 years—demonstrates Walmart’s proactive approach to share price management.

The Mathematical Marvel: From One Share to 1,536

The cumulative effect of these 12 splits creates a stunning transformation. An investor who purchased just one share during Walmart’s 1970 IPO would now hold 1,536 shares after all splits through 2024. This represents more than a 1,500-fold increase in share count alone, before considering any dividend reinvestment or additional purchases.

Breaking down this multiplication reveals the power of compound splitting. Each 2-for-1 split doubles the share count, while the recent 3-for-1 split triples it. I calculate this progression as follows:

- 1971: 2-for-1

- 1975: 2-for-1

- 1980: 2-for-1

- 1982: 2-for-1

- 1985: 2-for-1

- 1987: 2-for-1

- 1990: 2-for-1

- 1993: 2-for-1

- 1999: 2-for-1

- 2020: 2-for-1

- 2024: 3-for-1

The frequency of these splits tells a story about Walmart’s consistent growth trajectory. During periods of rapid expansion, particularly in the 1980s when the company was aggressively expanding across the United States, splits occurred more frequently. This pattern reflects the stock’s appreciation as investors recognized the company’s potential.

Understanding this split history helps explain why Walmart’s stock split strategies have been so effective at maintaining broad investor participation. Each split reset the share price to a more accessible level, allowing new investors to purchase round lots without significant capital requirements.

The IPO share multiplier of 1,536 represents one of the highest ratios among major blue-chip stocks. This figure doesn’t include the substantial dividend payments Walmart has made over the decades, which would have allowed shareholders to purchase additional shares through reinvestment programs.

The strategic timing of these splits often coincided with periods of strong business performance and stock appreciation. I’ve observed that Walmart typically announced splits when the share price reached levels that might have deterred smaller investors, usually in the $100-150 range in recent decades.

The consistent execution of stock splits reflects management’s confidence in the company’s long-term prospects and their commitment to maintaining an accessible share price. This approach has contributed to Walmart’s broad shareholder base and has helped establish the stock as a cornerstone holding for many retail investors.

The transformation from one original IPO share to 1,536 shares demonstrates how disciplined corporate actions, combined with solid business execution, can create extraordinary long-term value. While splits don’t create inherent value, they’ve helped Walmart maintain its position as one of the most widely held stocks among individual investors, contributing to the stability and liquidity that characterizes global equity markets today.

Why Walmart Stopped Splitting for 25 Years Before the 2024 Return

Walmart’s stock split history reveals a fascinating evolution in both corporate strategy and market dynamics. During the 1980s and 1990s, the retail giant executed splits every 2–3 years, closely aligning with periods of explosive corporate expansion. These frequent splits served as visible markers of the company’s rapid growth trajectory and helped maintain share prices within ranges accessible to retail investors.

The Great Pause: Understanding the 25-Year Hiatus

After 1999, Walmart’s splitting activity came to an abrupt halt, despite continued business growth. This strategic shift reflected fundamental changes in the investment landscape. The company’s investor base underwent a dramatic transformation, with institutional ownership climbing to approximately 72%. Large institutional investors like pension funds and mutual funds operate with different accessibility needs compared to individual retail investors, making high share prices less problematic for their investment strategies.

Fractional share investing emerged as another game-changing factor during this period. Major brokerages began offering fractional shares, effectively solving the accessibility problem that stock splits traditionally addressed. Investors could now purchase portions of expensive stocks, eliminating the need for companies to split shares purely for affordability purposes.

The Strategic Return in 2024

The decision to implement a 3-for-1 stock split in 2024 signals management’s renewed confidence in future growth prospects. Stock splits often generate short-term investor interest and increased trading volume, creating positive momentum around the company’s shares. This psychological boost can be particularly valuable during periods when management wants to emphasize optimism about business fundamentals.

Historical trading volume patterns show that splits typically create temporary spikes in market activity. Retail investors, despite representing a smaller portion of Walmart’s ownership structure, still respond enthusiastically to splits. The increased accessibility can attract new individual investors who prefer lower nominal share prices, even though the underlying value remains unchanged.

The timing of Walmart’s 2024 split coincides with broader trends in global equity markets, where companies are increasingly using splits as communication tools rather than purely functional mechanisms. Management teams recognize that splits can serve as powerful signals of confidence, particularly valuable in competitive retail environments where investor sentiment significantly impacts stock performance.

The shift from frequent splitting to a 25-year pause and then a strategic return illustrates how corporate finance decisions adapt to changing market conditions and investor preferences.

E-Commerce Growth and Business Fundamentals Driving the Split Decision

Walmart’s decision to implement a stock split stems from several powerful fundamental factors that demonstrate the company’s exceptional performance and strategic positioning in today’s retail landscape. The retail giant’s impressive financial metrics create compelling reasons for management to make shares more accessible to a broader investor base.

Core Performance Metrics Supporting the Split

Several fundamental indicators factored into Walmart’s split decision, each reflecting the company’s strong operational execution:

- Revenue growth consistently exceeding industry benchmarks

- Operating margin expansion through improved efficiency and cost management

- E-commerce acceleration significantly outpacing traditional retail growth rates

- Enhanced competitive positioning against both traditional and digital-first retailers

- Capital allocation strategies that balance growth investment with shareholder returns

E-commerce performance stands out as perhaps the most significant catalyst behind the split timing. Before the 2024 split announcement, Walmart’s e-commerce segment achieved remarkable 27% year-over-year growth, substantially surpassing the 20% threshold that analysts often associate with stock split announcements. This digital transformation demonstrates Walmart’s successful adaptation to changing consumer preferences and validates its massive technology investments.

Revenue growth across all segments reinforces management’s confidence in the company’s trajectory. Operating margin expansion reflects improved operational efficiency and the benefits of scale, while the competitive landscape shows Walmart strengthening its market position against both traditional retailers and e-commerce pure-plays like Amazon.

Dividend policies and capital return strategies also influence split decisions. Walmart recently increased its dividend by 10.5%, signaling strong cash flow generation and management’s commitment to rewarding shareholders. Importantly, this dividend increase occurred without major changes to share buyback policies, indicating the company’s financial flexibility and sustainable cash generation capabilities.

The combination of these factors creates what management considers an optimal environment for a stock split. Strong fundamentals justify the current valuation while robust growth prospects, particularly in e-commerce, suggest continued appreciation potential. The split decision reflects management’s confidence that current performance levels are sustainable and that making shares more affordable will benefit long-term investors.

These fundamental drivers position Walmart advantageously within global equity markets, where investors increasingly value companies demonstrating both traditional retail strength and digital innovation capabilities. The split decision capitalizes on this convergence while making the investment opportunity accessible to a wider range of market participants.

The Math Behind Long-Term Wealth Creation Through Splits and Appreciation

The numbers behind Walmart’s stock evolution tell a compelling story about patient investing. When I examine what happened to a single share purchased at Walmart’s IPO, the transformation is remarkable—that one share would equal 1,536 shares today through the combination of stock splits and appreciation. This multiplication effect demonstrates how splits can amplify returns for investors who maintain their positions across decades.

Stock splits create a powerful compounding mechanism that works alongside business growth. Each time Walmart executed a split, existing shareholders received additional shares proportional to their holdings. The recent 3-for-1 split continues this tradition, tripling share counts while maintaining total investment value. However, the real wealth creation comes from the combination of these splits with consistent business performance and stock appreciation over time.

Common Investor Mistakes That Diminish Returns

Critical errors in understanding stock splits can significantly impact investment outcomes. Research shows that investors who misinterpret splits or focus solely on them without considering business fundamentals can lose 12–18% in potential annual returns. Several specific mistakes stand out:

- Believing splits automatically create value or drive price appreciation

- Selling shares immediately after split announcements to “take profits”

- Focusing on share count increases rather than underlying business performance

- Misunderstanding how splits affect dividend yields and earnings per share calculations

- Making investment decisions based on split announcements rather than company fundamentals

The mathematical reality shows that splits function as neutral events from a value perspective. A $100 investment remains worth $100 immediately after any split, regardless of how the shares multiply. The true wealth creation occurs when strong business performance drives share price appreciation after the split adjustment.

Effective investors approach splits within a broader analytical framework. I’ve observed that successful long-term investors examine splits as one component of management’s capital allocation strategy while emphasizing business fundamentals like revenue growth, profit margins, and competitive positioning. Market trends support this approach, showing that companies with strong operational performance tend to deliver superior returns regardless of their splitting frequency.

The compounded returns from Walmart’s journey illustrate why patience and proper understanding matter. Those 1,536 equivalent shares represent decades of consistent business execution, strategic expansion, and prudent financial management. The splits simply made the shares more accessible and liquid while the underlying business drove value creation. Understanding this distinction helps investors make informed decisions about split opportunities in their portfolios.

How Walmart’s Split Strategy Compares to Amazon, Target, and Costco

Walmart’s aggressive stock split strategy stands apart from its retail competitors, revealing distinct approaches to share price management across the industry. The retail giant’s track record of 12 splits, culminating in a remarkable cumulative 1,536:1 effect, positions it as the most split-active among major U.S. retailers.

Split History Across Major Retailers

Amazon recently reignited interest in stock splits with its massive 20-for-1 split in 2022, marking a significant departure from its previous split-averse stance. This move brought Amazon’s share price down from over $2,000 to a more accessible range, demonstrating how even tech-driven companies can embrace stock splitting as market conditions evolve. The timing coincided with broader discussions about key trends developing in global equity markets, where accessibility increasingly matters for retail investors.

Target presents a middle-ground approach with 5 total splits since going public, achieving a cumulative 48:1 effect. However, the retailer hasn’t executed a split since 2000, despite experiencing substantial growth over the past two decades. This conservative stance reflects Target’s preference for organic share price appreciation over frequent adjustments through splits.

Costco exemplifies the split-averse philosophy among established retailers. With only 2 splits in its history resulting in a modest cumulative 4:1 effect, the warehouse club giant has allowed its shares to trade above $400 without implementing any recent splits. This approach suggests confidence in the company’s ability to attract institutional and high-net-worth investors regardless of absolute share price levels.

The contrast becomes even sharper when examining retailers like Dollar General and PriceSmart, which have never executed stock splits. These companies maintain their original share structures, focusing on business fundamentals rather than share price psychology.

Walmart’s extensive splitting history reflects a deliberate strategy to maintain share price accessibility. The company’s latest announcement of a 3-for-1 stock split continues this pattern, demonstrating consistent commitment to keeping shares within reach of individual investors. This approach has practical implications for employee stock purchase plans and retail investor participation.

The divergent strategies reveal different philosophies about market accessibility. Tech companies like Amazon, after years of allowing shares to reach premium levels, have recently embraced splits to broaden ownership. Traditional retailers show mixed approaches:

- Walmart champions accessibility through frequent splits.

- Target focuses on long-term price growth without recent splits.

- Costco embraces high prices, appealing to long-term and institutional investors.

These differences reflect varying investor bases and market positioning strategies. Walmart’s consistent splitting pattern aligns with its focus on everyday consumers, extending this philosophy to its stock ownership. Costco’s higher share price doesn’t deter its member-focused investor base, who typically demonstrate longer-term investment horizons.

The cumulative effects tell a compelling story. Walmart’s 3-for-1 stock split will further extend its lead in cumulative split ratios among retailers. Amazon’s single large split, while impactful, still trails Walmart’s decades-long splitting strategy. Target’s dormant split activity suggests comfort with current price levels, while Costco’s minimal splitting indicates confidence in attracting investment regardless of share price barriers.

Market conditions increasingly favor companies that prioritize retail investor access. Commission-free trading platforms and fractional share ownership have reduced some barriers, but psychological price points remain influential. Walmart’s splitting strategy acknowledges these factors, maintaining momentum in an environment where retail participation continues growing.

The retail sector’s varied approaches to stock splits highlight different priorities in investor relations and market positioning. While some companies allow shares to reach premium levels, others actively manage accessibility through regular splitting schedules. These decisions reflect broader corporate philosophies about ownership democratization and long-term shareholder engagement strategies.

Sources:

MLQ.ai – Walmart WMT Stock Splits

PocketOption – Is Walmart Stock Going to Split? 7 Prediction Metrics with 76% Accuracy

PocketOption – WMT Stock Split History: 5 Critical Mistakes Costing

Mitrade – If You Bought 1 Share of Walmart at Its IPO, Here’s How

CheddarFlow – Walmart Stock Split History, Impact and What Investors Should Know

AInvest – WMT Stock Split Analysis

CompaniesMarketCap – Walmart Stock Splits

Morningstar – What Does Walmart’s Stock Split Mean for Investors