Netflix prices hike plans as it solidifies its position as a dominant force in the streaming landscape, analysts at UBS Securities predict a significant development in 2024: a price increase for its subscription plans. This move, expected to bolster revenue and earnings growth, underscores Netflix’s ongoing efforts to expand its market share amidst a rapidly evolving media landscape.

Anticipating Price Adjustments

According to UBS analysts led by John Hodulik, Netflix prices is poised to implement rate hikes on its streaming plans in the coming year. This strategic decision, coupled with revenue gains from its ad-supported tier and steady subscriber growth, is projected to drive a robust 15% increase in total revenue for the company in 2024, a notable surge compared to the 7% growth observed in the previous year.

Netflix Prices Past Increases and Future Expectations

Netflix has a history of adjusting subscription prices, as evidenced by the uptick in the Basic plan’s cost from $9.99 to $11.99 per month in the U.S. last October. While specific details regarding the upcoming Netflix prices adjustments remain undisclosed, executives have hinted at the likelihood of rate hikes in 2024. Greg Peters, Netflix co-CEO, emphasized the company’s intention to resume its standard approach to pricing following the rollout of the paid-sharing program, signaling a return to business as usual.

Investor Confidence and Market Response

In response to these projections, UBS has raised its 12-month price target on Netflix shares from $570 to $685 per share, maintaining a “buy” rating on the stock. This optimistic outlook has resonated positively with investors, as Netflix shares experienced a 1.5% increase, surpassing $596 per share in midmorning trading on Tuesday.

Dominance in Streaming

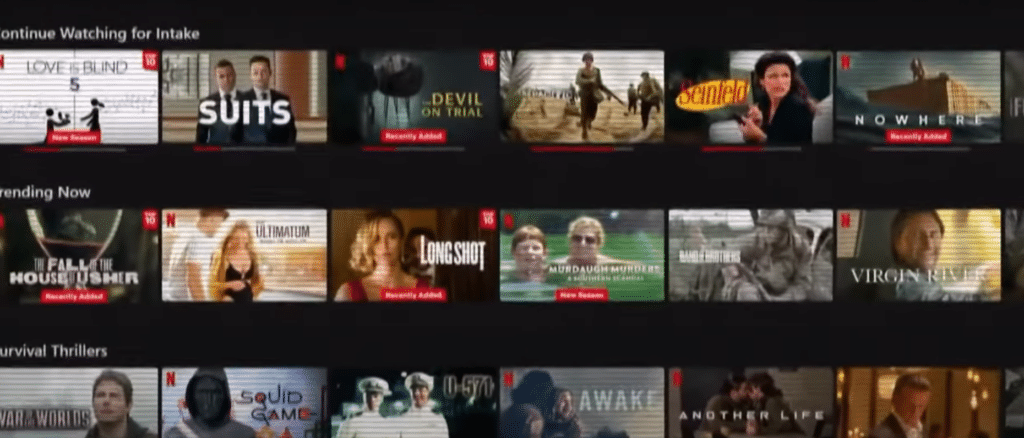

Netflix’s growing share of U.S. TV viewing further solidifies its position as a frontrunner in the streaming arena. Nielsen data indicates a rise in Netflix’s share to 7.9% in January 2024, up from 7.7% the previous month. Additionally, the platform’s competitive pricing relative to other streaming services, coupled with its expansive content library, reinforces its appeal among consumers.

The Netflix Advantage

Analysts at UBS underscore Netflix’s status as the primary beneficiary of structural shifts in the media landscape. Traditional media companies, grappling with declining linear TV businesses, have pivoted towards profitability in streaming. This paradigm shift, characterized by price adjustments, platform consolidation, and content curation, positions Netflix as a key player poised to capitalize on industry rationalization.

Future Growth Projections

Looking ahead, UBS has revised its estimates for Netflix’s net subscriber additions in 2024, projecting an increase from 18 million to 20 million. Furthermore, the company anticipates a steady expansion in operating margins, driving a compound annual growth rate (CAGR) of 26% in operating income through 2027. These optimistic projections underscore Netflix’s continued momentum and potential for sustained growth in the years to come.

The New Playbook: Adapting to Industry Dynamics

In response to evolving market trends, media companies are embracing a new playbook aimed at driving profitability in streaming. This strategic framework includes a combination of Netflix prices increases, platform consolidation, content curation, and a renewed focus on content licensing. As the objective shifts from subscriber growth to profitability, Netflix emerges as a frontrunner poised to capitalize on these structural changes, leveraging its expansive content library and market dominance to maintain a competitive edge.

A Strategic Evolution

Netflix’s decision to raise subscription prices was a strategic maneuver aimed at aligning revenue growth with its expanding user base. As Netflix navigates the ever-changing landscape of streaming entertainment, its strategic initiatives, including price adjustments and content investments, position it for continued success. With a steadfast focus on profitability and innovation, Netflix remains at the forefront of shaping the future of digital entertainment, poised to deliver value to both investors and consumers alike.